Finance

The Magog Trust, which is a company limited by guarantee, is also a registered charity and registered farmer. This means it has to abide by regulations applying to companies, charities and farmers.

As a charity we are exempt from income and corporation taxes and are able to reclaim Gift Aid on qualifying donations.

We are registered for VAT. This allows us to recover the VAT that we pay but we also have to account to HMRC for the VAT on car parking fees and the subscriptions which entitle Friends and Members to enjoy free parking.

How much do we receive and what does it cost?

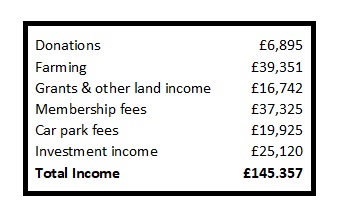

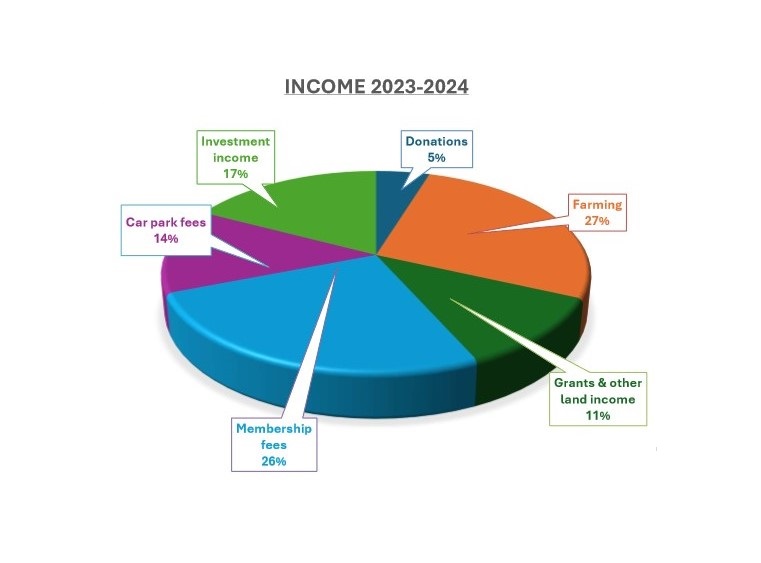

Income

Since 2nd January 2019, income from car parking fees and subscriptions which provide free parking have become a significant proportion of the Trust’s income. They now represent 40% of the total. Farming and related grants, together with investment income from the endowment fund, make up most of the rest.

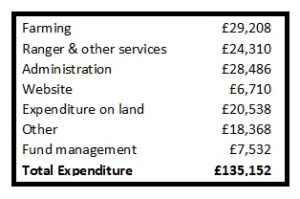

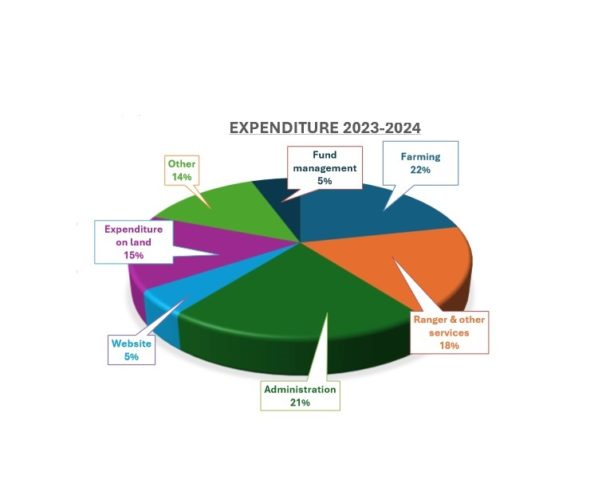

Expenditure

Farming represents the largest single item of expenditure but this has to be set against the income it generates. For 2023-24, farming and its related grants made a surplus of £18,938.

All other costs, except those related to the management of our investments, legal fees and website, amounted to £85,731. This is indicative of what it costs to conserve the landscape and maintain it for public amenity and access.

Income 2023-2024

Expenditure 2023-2024

The Annual Report and Accounts for the year ending 31 March 2024 can be downloaded here.

The minutes of the last AGM, held on 17 September 2024, can be downloaded here.